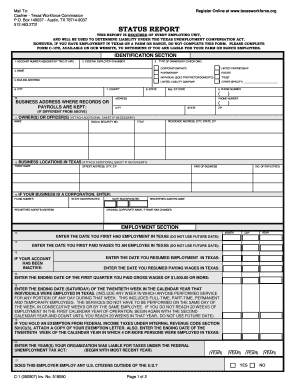

TX BI-99E/S 2016-2025 free printable template

Show details

Texas Workforce CommissionUnemployment Benefits Handbook.texasworkforce.org Register as a job seeker at WorkInTexas.com BI99E/S (06/16)Texas Workforce Solutions: Help for Job Seekers Texas Workforce

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX BI-99ES

Edit your TX BI-99ES form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX BI-99ES form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing TX BI-99ES online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit TX BI-99ES. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX BI-99E/S Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX BI-99ES

How to fill out TX BI-99E/S

01

Obtain the TX BI-99E/S form from the Texas Department of Insurance website or your local insurance office.

02

Fill in your personal information, including name, address, and contact details in the designated fields.

03

Provide details about the business or activity for which the coverage is being sought.

04

Indicate the type of insurance coverage being requested, such as general liability or workers' compensation.

05

Review the form to ensure all required information is complete and accurate.

06

Sign and date the form at the bottom to authenticate your submission.

07

Submit the completed form to the appropriate insurance provider or agency as instructed.

Who needs TX BI-99E/S?

01

Individuals or businesses in Texas who are seeking insurance coverage for their operations or activities.

02

Self-employed individuals looking for coverage options to protect against potential liabilities.

03

Employers who need to provide workers' compensation insurance for their employees.

Fill

form

: Try Risk Free

People Also Ask about

How much is Missouri unemployment per week?

Your weekly benefit amount (WBA) is 4 percent of the average of your two highest quarters in the base period. Missouri′s maximum WBA is $320. Twenty weeks of benefits is the maximum allowed during your benefit year. See the Unemployment Benefit Calculator or view Eligibility for Unemployment Benefits for more details.

Am I eligible for unemployment?

Requirements to Apply Have earned enough wages during the base period. Be totally or partially unemployed. Be unemployed through no fault of your own. Be physically able to work.

What is the longest you can be on unemployment?

Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program, although 12 states provide fewer weeks, and two provide more. Extended Benefits (EB) are not triggered on in any state.

How do I know if my unemployment claim was approved?

You can check your claim status online at Unemployment Benefits Services or call Tele-Serv at 800-558-8321. We use information from you and your last employer to determine if you qualify. TWC sends your last employer a letter with the reason you gave for no longer working there.

How long does unemployment last?

Workers in most states are eligible for up to 26 weeks of benefits from the regular state-funded unemployment compensation program, although 12 states provide fewer weeks, and two provide more. Extended Benefits (EB) are not triggered on in any state.

What happens if you get caught lying on unemployment?

You may face criminal prosecution and imprisonment. You may incur severe fines and penalties. Your state or federal income tax refunds may be garnished to satisfy any money owed. You can be denied unemployment benefits in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my TX BI-99ES in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your TX BI-99ES along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I send TX BI-99ES to be eSigned by others?

To distribute your TX BI-99ES, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an electronic signature for signing my TX BI-99ES in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your TX BI-99ES directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is TX BI-99E/S?

TX BI-99E/S is a tax form used in Texas for businesses to report certain information related to their business operations and tax obligations.

Who is required to file TX BI-99E/S?

Businesses operating in Texas that meet specific criteria, such as certain corporations and partnerships, are required to file TX BI-99E/S.

How to fill out TX BI-99E/S?

To fill out TX BI-99E/S, businesses must provide accurate business information, complete the designated sections of the form, and ensure all required documentation is attached before submission.

What is the purpose of TX BI-99E/S?

The purpose of TX BI-99E/S is to collect business data for tax compliance and to assess the economic impact of businesses in Texas.

What information must be reported on TX BI-99E/S?

Businesses must report details such as business name, tax identification number, income, deductions, and other financial information as required by the form.

Fill out your TX BI-99ES online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX BI-99es is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.